Having failed to breach $47,000, Bitcoin went through a rollercoaster this week following a price slump from over a 4-months high of around $52K on the day El Salvador official made Bitcoin a legal tender in the country. Though BTC recovered several thousand, it has failed to breach $47k since then.

BTC lost over $10k hours after reaching a 4-months high, prompting analysts and traders to question whether the bear market is making a surge back to the market. This price slump is however just a correction in the short-term market, as the bulls continue to make recovery. For a fact, the near-term charts appear bearish, on-chain, and technical data remains very bullish as the current correction is only but a shakeout paving way for high prices in the coming months.

For the near term, it is very important that Bitcoin continues to protect the 200-day MA at $46k and resume covering high grounds.

CrytoQuant CEO, Ki-Young Ju talking about the trend of the whales shared a chart regarding on-chain data/activities of the whales. Ki pointed out that a higher push of the 30-day MA of Bitcoin flow mean happens, it historically leads to significant rallies in the future months.

Republic of Panama To Recognize Bitcoin As An Alternative Payment Method

Global adoption of Bitcoin and other cryptocurrencies continues to soar as Panama proposes a bill to accept Bitcoin as an alternative global method of payment in the country.

The new bill aims at regulating crypto thereby enabling freedom to use crypto on the shores of Panama.

Lawmaker and pro-crypto congressman Gabriel Silva enthusiastically noted that the bill preparation of the bill had all hands on deck with individuals from different political parties, industry, and technology experts were involved in the process. Silva also stated that the legislation is to foster innovation and expand financial services beyond the current state.

While Panama’s bill may have been motivated by El Salvador’s oinBitcoin law, Panama’s approach is a different one from the former. A draft released by Silva shows that the bill seeks to give freedom of usage of Bitcoin and other cryptocurrencies just like fiats in the region and to enable fast and low-cost payments, so as to allow citizens to complete transactions regardless of distance.

‘Bitcoin Day’ In El Salvador As Bitcoin Becomes A Legal Tender

The world stood still on September 7 as the Central American country El Salvador becomes the first country to officially recognize a cryptocurrency as legal tender.

After making the purchase of the first set of 200 BTC taking its Bitcoin holding to 400 BTC, President Nayib Mutele shared a tweet highlighting the progress of the process, also nothing that they aim at making more purchases of the cryptocurrency giant.

https://twitter.com/nayibbukele/status/1434968475928248331?ref_src=twsrc%5Etfw

El Salvador’s Bitcoin law that took effect on Tuesday also received solidarity support from the Latin American crypto community on Reddit. Members of the community with over 3 million members pledged to make a purchase of $30 worth of BTC to mark September 7 as ‘Bitcoin day’. The community chose $30 as a form of solidarity support to the El Salvadorian Government who will be giving her citizens $30 worth of BTC through its official wallet Chivo.

President Bukele made the most of the moment as he used the opportunity to lure investors to El Salvador;

https://twitter.com/nayibbukele/status/1401622548396314631?ref_src=twsrc%5Etfw

Although the Bitcoin Law was marred by ‘server capacity errors’, faced by the official wallet ‘Chivo‘, technical teams proceeded to fix the server glitch to increase the capacity of the image capture servers.

Even though El Salvador has made BTC an official legal tender, the Central American nation will not be replacing the dollar, a major reason why provision for BTC ATMs was made available so her citizens can easily convert BTC and withdraw as US dollars.

What Experts Are Saying

Bitcoin experienced a market crash the same day El Salvador made the digital currency giant a legal tender, causing tension and confusion. Here are experts’ take on the crash;

Cointelegraph contributor and market expert Michaël van de Poppe highlighted the role that overleveraged traders played in the day’s price action.

Willy has this to say;

Woo stated that the day opened with equities risk-off which placed huge pressure on the market.

“Leave it to whales to dump Bitcoin on the day that El Salvador makes it legal tender,”

Were the exact words of analyst Scott Melker, popularly called ‘The Wolf of All Streets’

What The Bitcoin Technicals Are Saying

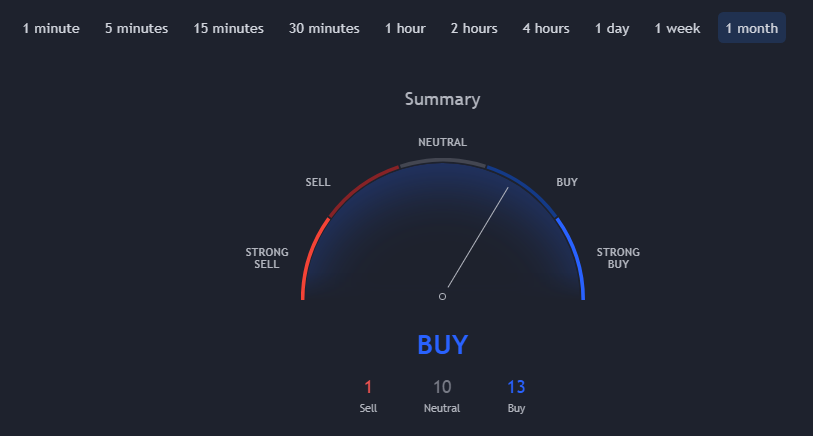

Trading View’s technicals over the past month show it supports a ‘ Strong Buy’ trend, a bullish signal. According to Trading View’s technical analysis, 13 of the 24 technical indicators are signaling “buy”. 10 remain “neutral” while 1 of the technical indicators signal “sell”. The technicals have maintained a positive outlook for weeks now and are still expected to remain so in the coming weeks.

The moving averages support a “strong-buy” action. With technicals signaling to buy, trading volume is expected to maintain an uptrend in the coming days.

CryptoCaptain Sentiment Analysis: 36% bearish

The bulls continue to make a comeback over the bears. CryptoCaptain’s market sentiment curve is seen to show an improvement tilting in favor of the bulls, a significant win even though the market experienced a huge correction on September 7, 2021.

Crypto Market Outlook

Crypto investors’ enthusiasm about the crypto market’s bull run and also the amount of their leveraged positions were a bit overextended. So, cryptos took a flash crash to shake out the overleveraged weak hands when Bitcoin dropped from 52k to 42k due to a cascade of liquidations of leveraged trades – from which it quickly recovered to 47k. Nothing to worry about as long as support of 43-44k holds.

In this case, the longer-term bullish uptrend remains valid. Some coins like Cosmos Atom look decisively stronger than Bitcoin, bouncing back above pre-crash levels and reaching almost all-time-high levels. This can be interpreted as a bullish sign for the crypto market.

However, historically, September has been a weak or even a red month for crypto. Currently, the future direction of the market is unclear as the dust of the crash is about to settle and the price is ranging. Overall, many analysts expect a continuation of the bull run in the fourth quarter.

Looking for proper buy and sell signals building on years of analytical experience? Subscribe to our signal service. Join today