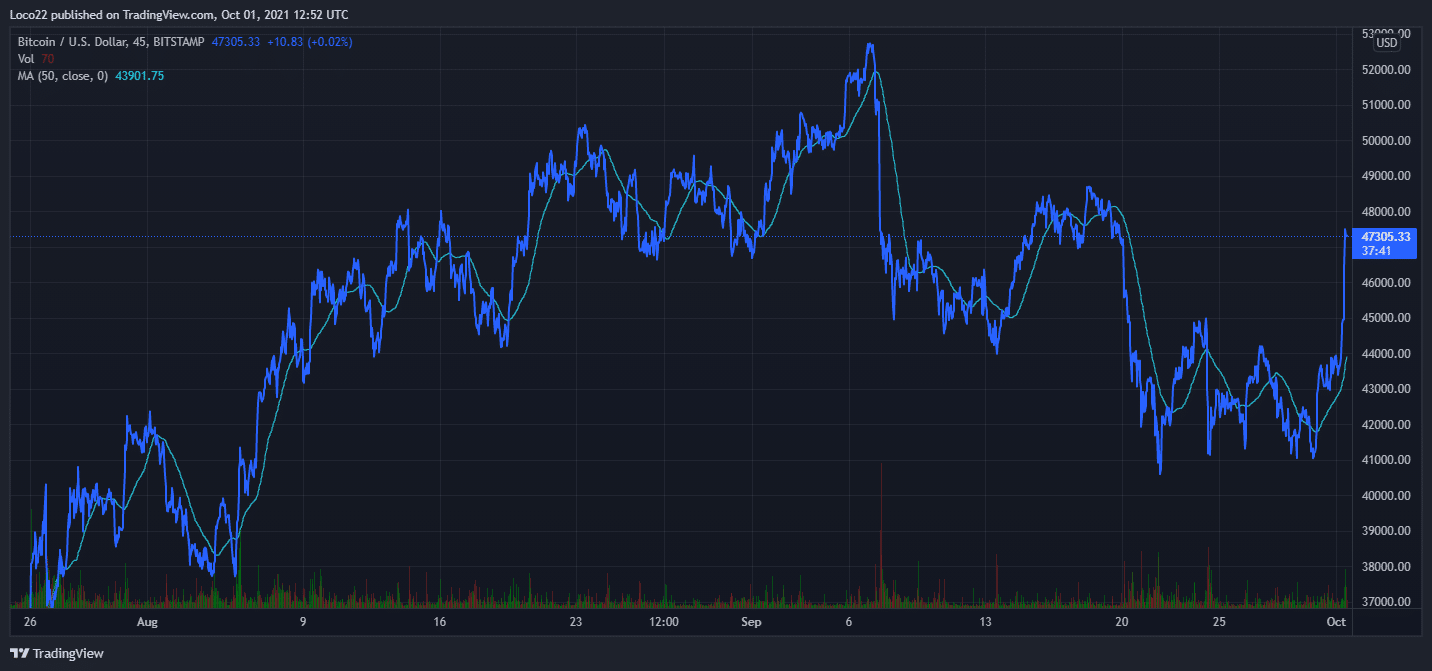

‘Uptober’ Bitcoin shoots despite being in the $41k-$43k region the entire trading week. An abrupt upside sees a fall of the resistance level and price explode to $47k for the first time since mid-September. Fed Chair Jerome Powell reassuring that the US has no plan to ban cryptocurrencies has help the entire crypto market to surge higher. Is this a sign that October will be a good month for the digital currency giant? Are we finally saying goodbye to the bears?

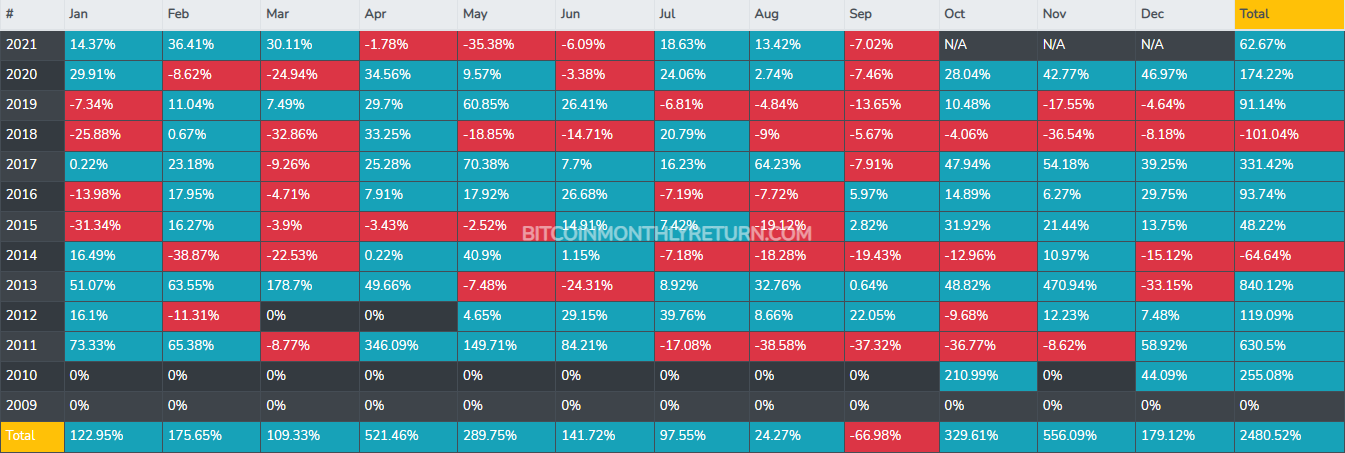

We are obviously starting the last quarter of 2021 with bullish candles, historic data has shown that October usually comes with good returns for the cryptocurrency giant and we are seeing signs of this already.

With September usually a bad month historically, we see from the table below that Bitcoin lost around 7.02% in September, supporting recent historic data.

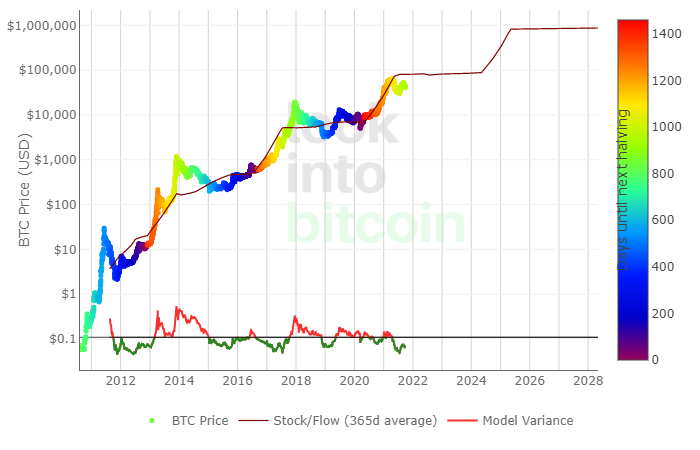

The Stock to flow (S2F) model, a model used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year) has remained the same over the past couple of months.

The US Has No Intention To Ban Bitcoin – Fed Chairperson Jerome Powell

The Fed has reiterated its willingness to work with crypto as against the plethora of bans seen in China. The US is seen to be taking a more open-minded approach.

Federal Reserve Chairman Jerome Powell during the House Financial Services Committee meeting on Thursday said the government has no intentions to place a ban on digital currencies, but also maintained that digital coins have to be regulated.

This optimistic step taken by the US made an immediate impact on the entire crypto market, with Bitcoin gaining over $2,000 in less then 24 hours finally shooting above $45k for the first time this week.

Crypto mining Receives Green Light in Iran

As part of its strides towards embracing cryptocurrency, the Iranian government has given the green light to crypto mining in the country following a drop in extreme summer heat.

The Middle Eastern country announced that it will allow licensed cryptocurrency miners to resume mining operations today following the earlier ban imposed by former President Hassan Rouhani in May 2021. The three months ban placed on crypto mining was due to the power shortage experienced as a result and summer heat causing more pressure on the nation’s power grid.

Reports have it that the country looks favorably at Bitcoin as a way to evade sanctions and embargo placed on it by the US government.

As mining activities are given the green light in Iran, Elliptic a blockchain analytics firm postulated that with the current mining levels in Iran, revenue from mining activities in the Middle Eastern country is estimated to be worth $1 billion.

What Experts Are Saying

Cryptocurrency expert with @100trillionUSD tweeted;

https://twitter.com/100trillionUSD/status/1443727392657350656?ref_src=twsrc%5Etfw

Highlighting September as a boring month in his recent Bitcoin market update on Youtube, Michael Van de Poppe also had this to say;

What The Bitcoin Technicals Are Saying

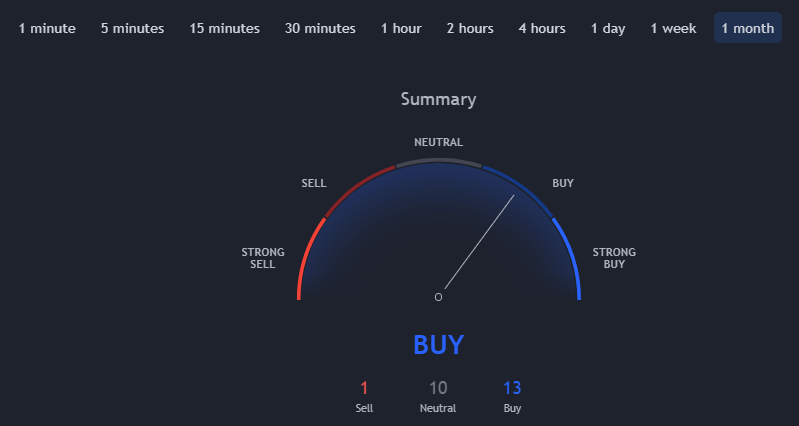

Trading View’s technicals over the past month show it supports a ‘Buy’ trend, a bullish signal. According to Trading View’s technical analysis, 13 of the 24 technical indicators are signaling “buy”. 10 remain “neutral” while 1 of the technical indicators signal “sell”. The technicals have maintained a positive outlook for weeks now and are still expected to remain so in the coming weeks.

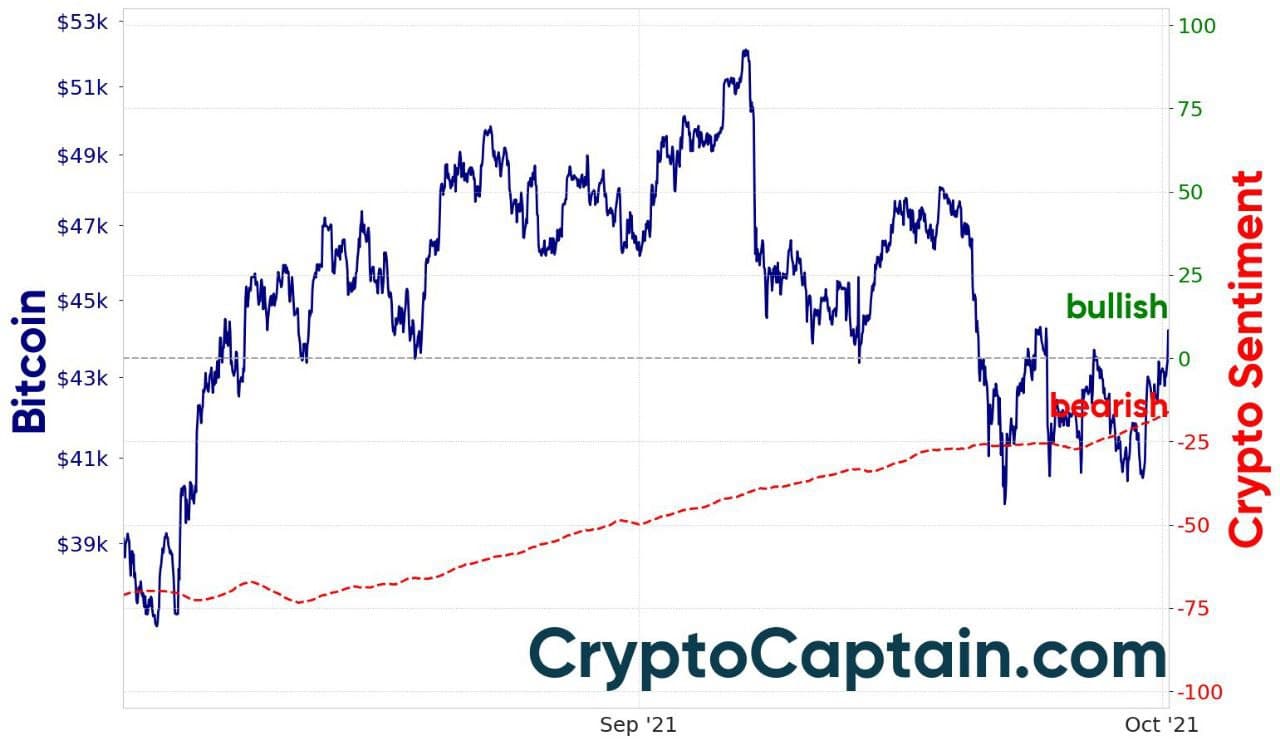

CryptoCaptain Sentiment Analysis: 16% bearish

Having overcome the effect of impulses as a result of the FUD created by the crypto ban in China last week, the bulls are showing no signs of relenting as they continue their victorious run over the bears.

Conclusion And Outlook

Last week the crypto market had seen many negative impulses coming from FUD created by the crypto ban in China, the FED potentially raising interest rates in the US and putting a threat on equities, finally, also seasonality might have impacted the crypto market negatively.

Now, it seems, the crypto market has digested the negativity and is heading towards a bullish Q4. Now, what are the reasons? When there’s no more space for negative news, the bottom is often closed. Seasonality also favors crypto in Q4, beginning today, with usually positive monthly returns over the board. Some bullish big news that is somewhat expected by the market is the SEC approving the first Bitcoin ETF in the US. Although it might be not a spot ETF holding actual coins, still it would have a big impact with potentially loads of investors’ money flowing into the crypto market. Besides that, there are also other trends of continuing adoption of crypto. So, in the long run, the market and prices should appreciate.

Technically, Bitcoin’s price broke out today of a descending triangle and pumped from $43k we saw yesterday towards $47k. That’s impressive! In the short run, there might be some retest of a former resistance level and when it holds, the first step towards a bullish Q4 might have been made. Alongside the technical perspective, also CryptoCaptain’s sentiment spirals upwards and strongly heads towards bullish.

Looking for proper buy and sell signals building on years of analytical experience? Subscribe to our signal service. Join today