State of the market

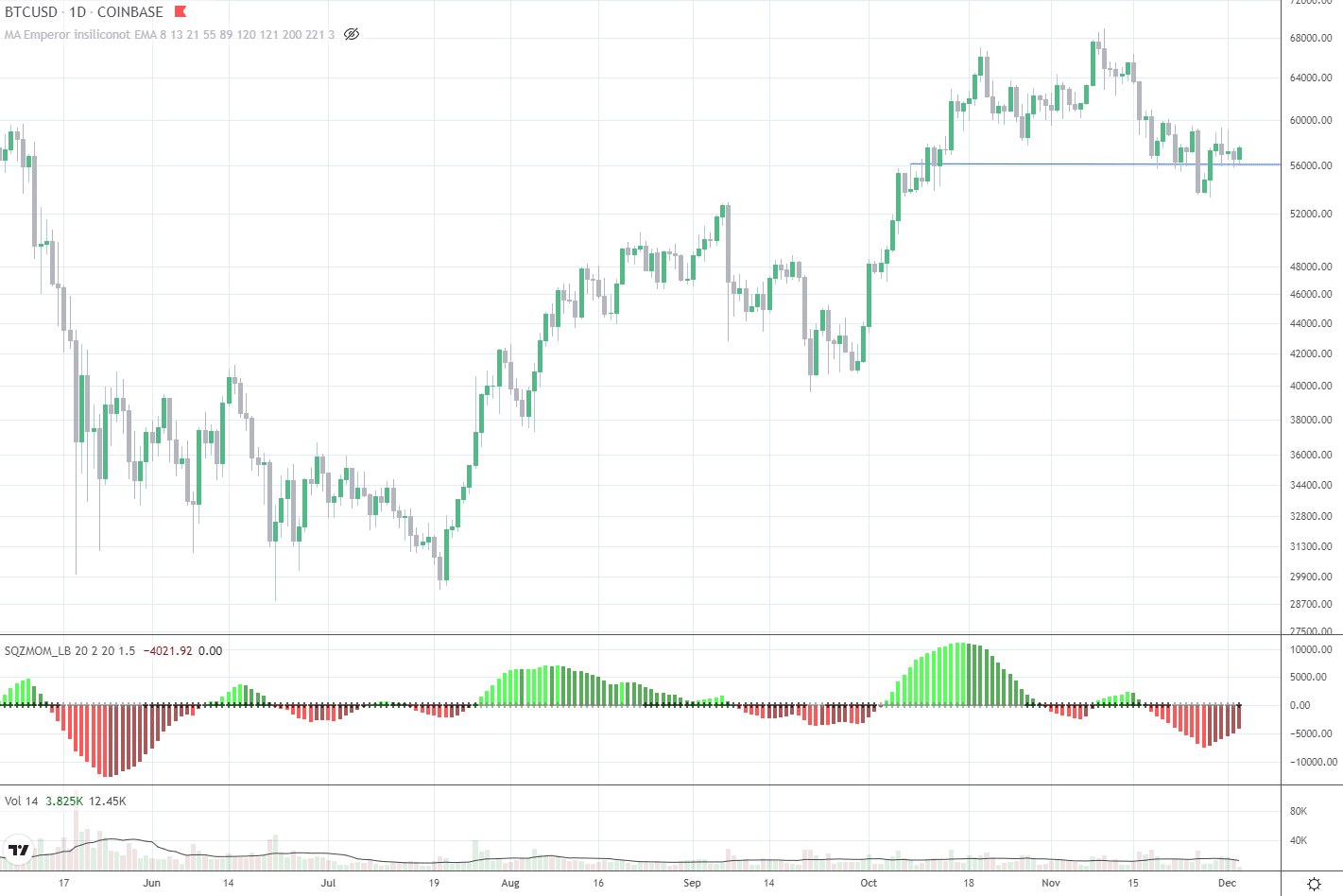

In this week, Bitcoin kept trending south, making lower highs on the chart. $56k held as support (see the blue line). But $60k could not break so far. Breaking $60k would be clearly a bullish signal. However, we are not there (yet). Thus, the market is a bit boring right now.

Where is the market heading?

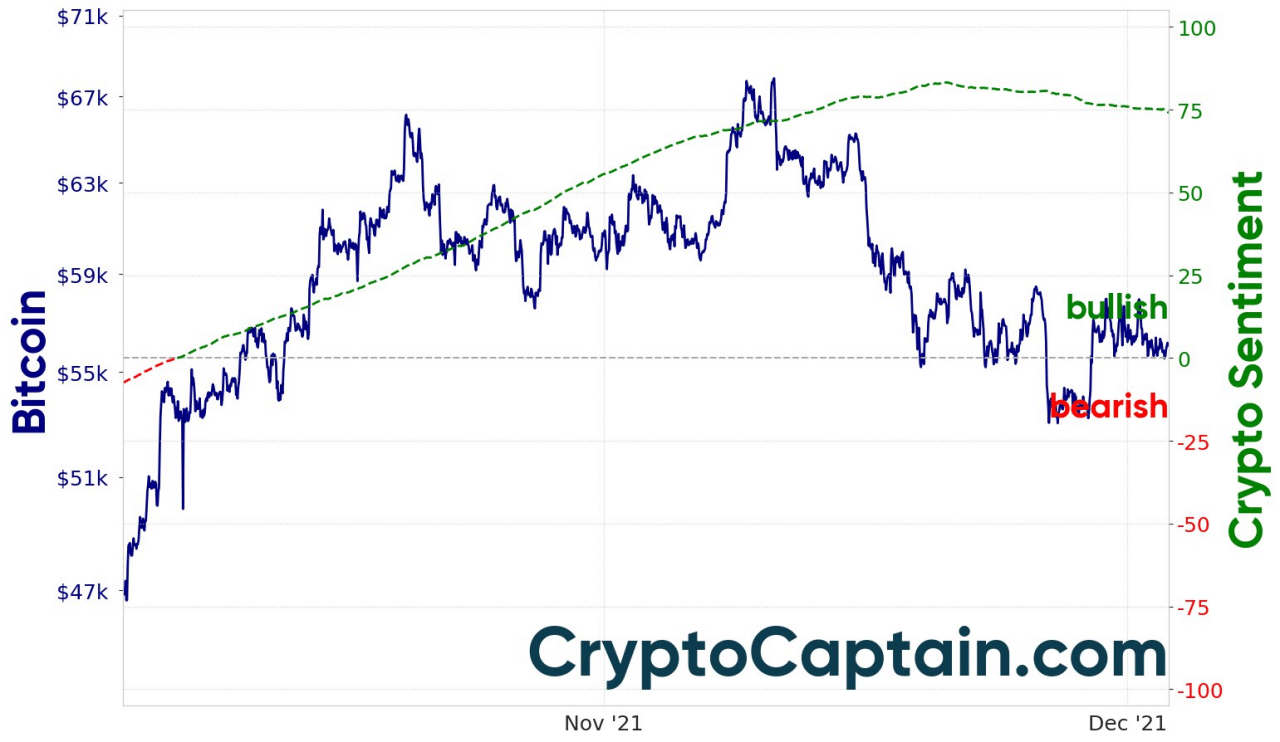

Due to the missing bullish confirmation in terms of price action, a breakdown to lower price levels is still a possibility. As 54k was already tested, the next lower one is around $49k. If we get there is unclear at the moment. Even if Bitcoin does, it wouldn’t destroy the bullish outlook on the longer run. Although prior market cycles – like the one in 2017 – ended in December – this doesn’t necessarily has to happen this time. CryptoCaptain’s market sentiment remains strongly bullish, although it retraced a little amidst the recent price dips in crypto.

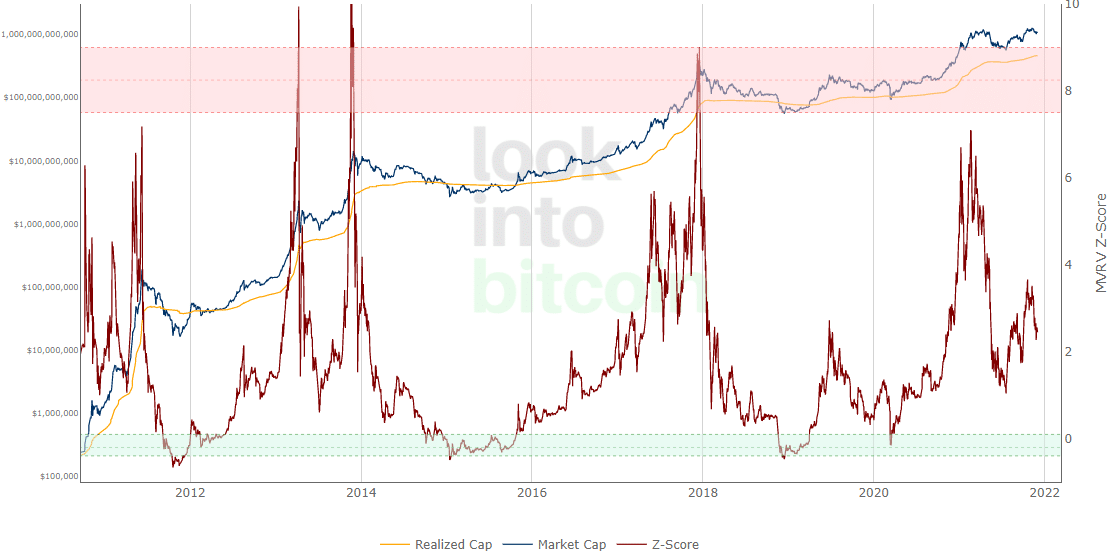

Also onchain indicators like the MVRV are far away from signaling a market top.

Therefore, a new bull run in early 2022 is absolutely possible.

Which coins to become interested in for the next crypto bull run?

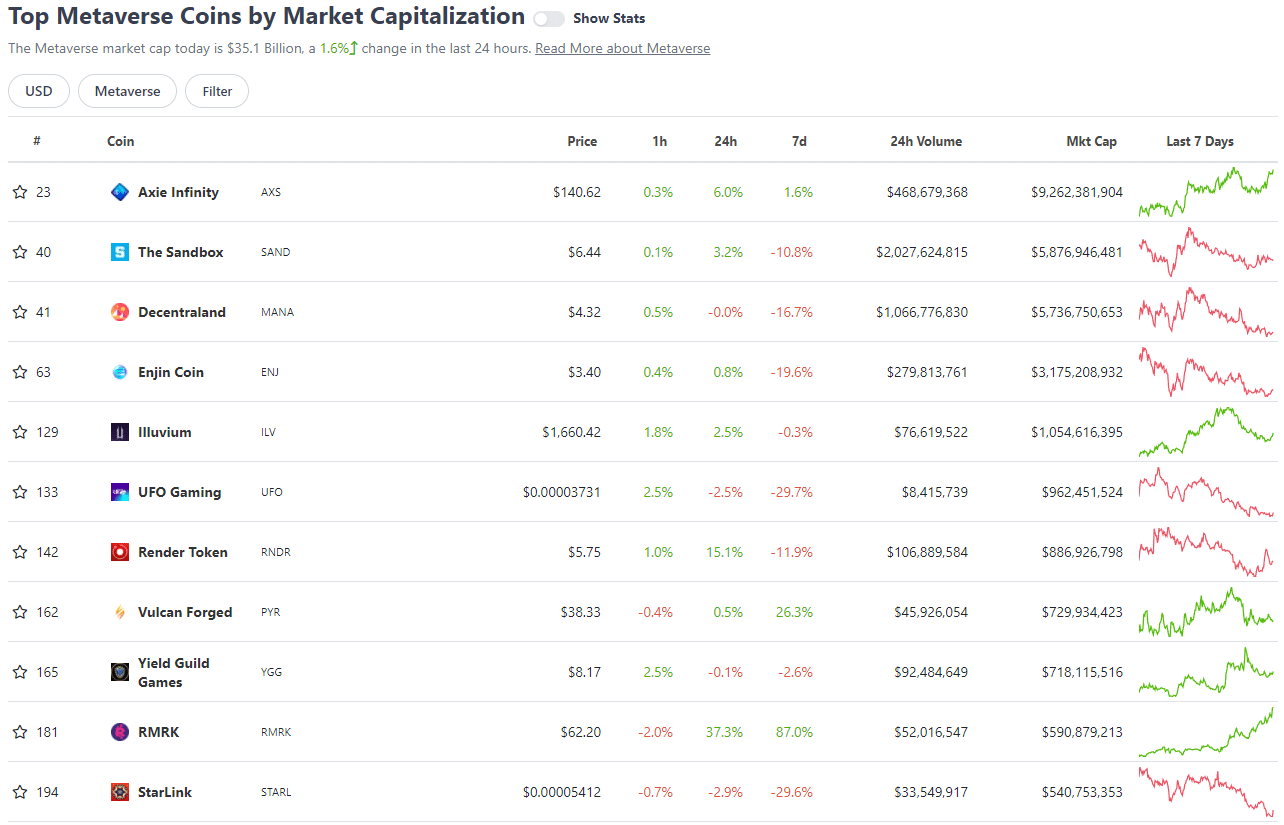

Now, which sectors and coins might be interesting, once the bull market resumes? Recently the “Metaverse” has been highly in favor after Facebook was renamed into “Meta”. To cover the metaverse space, lots of games are published that are connected to a blockchain and have their own token to buy land or items in the game.

Coingecko is actually a good site to do your own research which sectors are in favor. It allows to browse the performance of different sectors and dig into a list of coins of a sector, sorted by market capitalization. Regarding the Metaverse, the list shows the recent top performers Axie, Sandbox and Decentraland.

However, these top coins look damn overvalued – which does not mean that they cannot make another run. But it seems reasonable to look a bit lower in the list to find worthwile coins that did not have a big run yet and that have more room to climb upwards in the list. This idea leads us to coins such as Illuvium or Vulcan Forged. To dig further into metaverse and gaming coins, @LadyofCrypto1 or @ZssBecker are good Twitter accounts to follow in my opinion. In any case, Metaverse coins are highly speculative investments that might result in losing the complete investment.

Looking for substantial projects driving the crypto economy?

In an acylic manner it might be also worthwile to become interested in crypto market sectors that have become a bit out of favour recently. This includes Defi, oracles like Chainlink, but also Cardano, Cosmos, and Polkadot. Although it might be painful when considering a downtrending chart – when it looks bad and nobody is interested might actually be a good time to get interested. And then some patience might be required until the market picks up.

Personally, I like to invest in platforms that allow to build the next generation of decentralized applications, resulting in the emergence of whole new ecosystems. I think that’s much more valuable than investing in a single application. Ethereum is still the largest and most well known platform. Recently it showed a very strong price performance in comparison to Bitcoin. But many rivals are challenging Ethereum with innovative technology, providing improvements regarding scalability, lower fees, or security. Polkadot and Cosmos were already mentioned. Fantom, Polygon, Elrond, Solana, and Terra are other interesting ones. But again, some of them already observed huge runs.

Note that this text is not financial advice or a recommendation to buy any of the coins mentioned as everybody has their own risk appetite.

CryptoCaptain can help you time your entries and exits to max your profits and keep you safe from the next crash

No matter which coins one is interested in, it is absolutely cruicial to possess a good ability to time the market because when Bitcoin crashes, the whole market will. Would you like to be one of the first to know when the best time is to buy or sell cryptocurrencies? We build on a large data base and 10+ years of data science experience and we run our own AI. Join now to receive our signals!

Recently we also launched our wikifolios which will allow you to comfortably invest in our strategy directly by an exchange traded certificate. Currently we are in the process of making it investable, which will hopefully be the case around Februray 2022. Stay tuned!