In March 2020 the Corona Crisis pushed to the forefront of public attention in Europe, the US, and the rest of the world.

Spurred by worries of an economic breakdown, international stock markets saw a drastic crash of about -40% so far.

Usually, the correlation between the stock market and the crypto market is very low. Crypto currencies were even propagated by some as a store of value during a crisis.

Now, this time, major asset classes crashed concurrently and Bitcoin’s price dropped from about 10.000 USD to about 5.000 USD.

The effect of correlating asset classes was also seen during the 2008/2009 financial crisis.

In a short time, starting from 19 March 2020, Bitcoin was pumped to 6.500 USD.

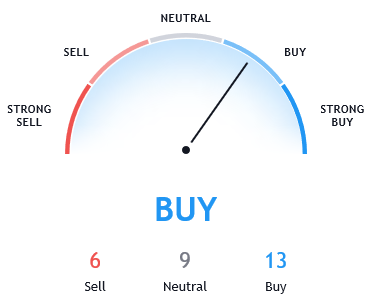

Based on our own short term analysis, sentiment has become more positive since 18 March after reaching the bottom of negativity on 14 March. Likewise, short term technical analysis with a time horizon of 4 hours suggests a buy signal.

However, the market is very volatile these days, very risky, and seems best suited for short term traders aiming at market swings over some days. Longer term investors should stay cautious.

A recent market comment on 20 March diagnosed “Bitcoin might be bluffing”. The author brings to our mind that the US stock market still could be heading lower and that cryptocurrencies like Bitcoin could follow up.

Another commentator also suggests we might be seeing a bull trap. In this line of thinking, weekly horizon technical analysis still suggests a sell.

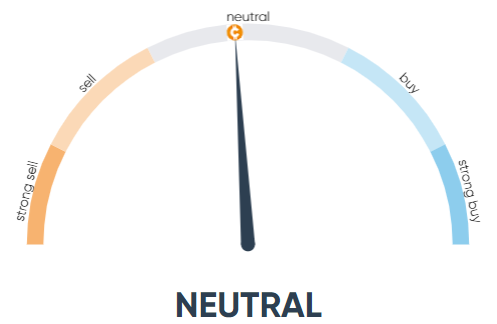

CryptoCaptain’s long term sentiment has been on approximately the same level since 03 February 2020. Due to the sentiment hovering at the same level for weeks, CryptoCaptain’s long term crypto sentiment is only very slightly negative und thus termed neutral. That is, the market crash is not supported by CryptoCaptain’s long term sentiment and might be reverted soon. When?

Our prime product for long term oriented DIY investors, the Bull Market Compass, suggests still waiting for buying into cryptos until volatility drops to reasonable levels and the long term sentiment starts a new hill climb.