CryptoCaptain’s Bull Market Compass sends favorable entries and exits into the crypto market to subscribing long-term investors.

The Bull Market Compass combines knowledge from the fields of big data, sentiment analysis, and predictive analytics using methods of artificial intelligence. Our service is backed by more than 10 years of scientific experience in these fields by the two co-founders (see Appendix).

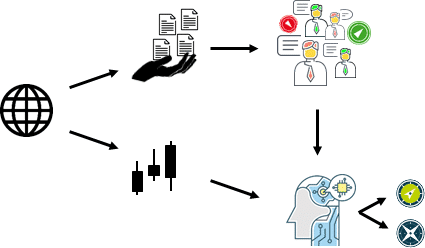

ANALYZING BIG DATA

CryptoCaptain retrieves and processes massive amounts of cryptocurrency-related articles and postings on an ongoing basis.

Related to our research we have found that many online articles are poorly written, computer written, copied from another source or the author is not knowledgeable on the matter. This leads to biases in the final market evaluation.

To avoid evaluation biases we carefully choose our sources. That is, sources must be reliable and with a broad reach. Sources must also present market analyses, predictions, and opinions in the investing community.

To improve the robustness of our investment strategies we make sure that articles have been written by a human. We also remove information, which is not related to an article such as ads, disclaimers, references to other articles, etc.

In addition to online articles and posts, we retrieve and process economic and cryptocurrency-related market data. In this context, we make sure that the data is consistent, properly time-stamped, and free of outliers.

Similar to the online articles we retrieve market data from reliable sources.

USING Sentiment TO TIME THE MARKET

To measure investors’ sentiment about the market, we employ state of the art algorithms. These include algorithms for machine learning, information extraction, information aggregation, text classification, and custom natural language processing.

In their sum, such algorithms allow us to extract, just like humans, predictive information from the retrieved articles and posts.

The algorithms that we use today were constantly refined and improved throughout our years of research. They can accurately determine the topics discussed in an article as well as authors’ opinion.

Ultimately we acquire information, which can tell us where the market is heading.

Our research shows that our market sentiment can be very effectively used to time favorable entry and exit points into the crypto market to profit early from emerging bull markets.

Our co-founder’s dissertation shows that market sentiment from online articles can be used to build an outperforming portfolio with little monthly effort. Compared to the general market such a portfolio has been shown to deliver substantially higher returns – even after accounting for transaction costs.

A great advantage of our approach is that unlike humans our algorithms constantly monitor the market sentiment and feed the results directly to our investment algorithms. In this fashion, we can swiftly notify investors about possible market turning points.

Sentiment also allows us to outperform traditional methods such as technical analysis in terms of investment timing.

Since we’ve started our research 10 years ago we’ve continuously experimented with and improved our algorithms and their accuracy. Today we feel confident enough to entrust them our own money.

If you made it this far then you are in luck as our service is now available to the general public.

About CRYPTOCAPTAIN

CryptoCaptain helps investors answer the question “When should I invest in the cryptocurrency market?“.

To help answer this question, we’ve developed the Bull Market Compass.

The Bull Market Compass is an investment signal service, which guides long-term investors through the volatile cryptocurrency market. In its core it is a powerful custom-built A.I. with remarkable predictive analytics capabilities.

On the one hand, it protects investors’ capital by early detecting bear markets and warning investors ahead of time.

On the other hand, it saves investors’ time by sending out quality investment signals and by monitoring the market for them.

Selected Scientific PUBLICATIONS

The founders of CryptoCaptain, Dr. Achim Klein and Lyubomir Kirilov, have a track record of several years in data science related to sentiment analysis, text mining, machine learning, and decision making in finance and crypto.

Klein, A., Riekert, M., & Dinev, V. (2019). Accurate retrieval of corporate reputation from online media using machine learning. In Proceedings of the 14th Federated Conference on Computer Science and Information Systems (FedCSIS 2019). Leipzig, Germany.

Klein, A., Dinev, V., & Riekert, M. (2019). Cryptocurrency crashes: A dataset for measuring the effect of regulatory news in online media. In Proceedings of the 1st Workshop on Systemic Risks in Global Networks (SysRisk2019) (pp. 85-88). Siegen, Germany.

Klein, A., Riekert, M., Kirilov, L., & Leukel, J. (2018). Increasing the Explanatory Power of Investor Sentiment Analysis for Commodities in Online Media. In International Conference on Business Information Systems (pp. 321-332). Springer, Cham.

Klein, A. (2017). Investor sentiment in blogs: design of a classifier and validation by a portfolio simulation. Dissertation.

Riekert, M., Leukel, J., & Klein, A. (2016). Online media sentiment: understanding machine learning-based classifiers. In Proceedings of the 24th European Conference on Information Systems (ECIS 2016). Istanbul, Turkey.